2 月 . 20, 2025 09:39

Back to list

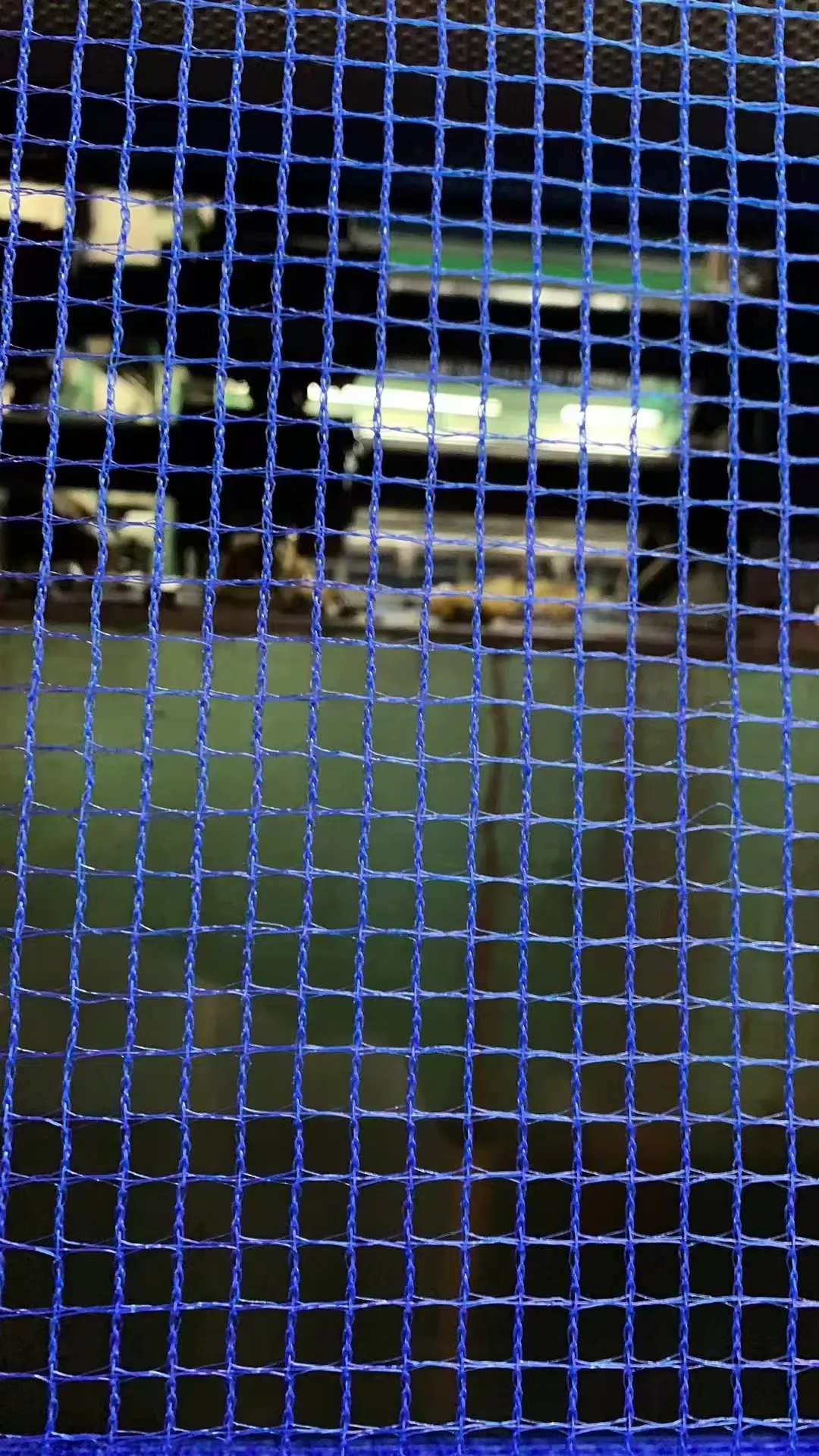

Sunshade Net for Greenhouse Sunblock Shade Cloth Cover Mesh

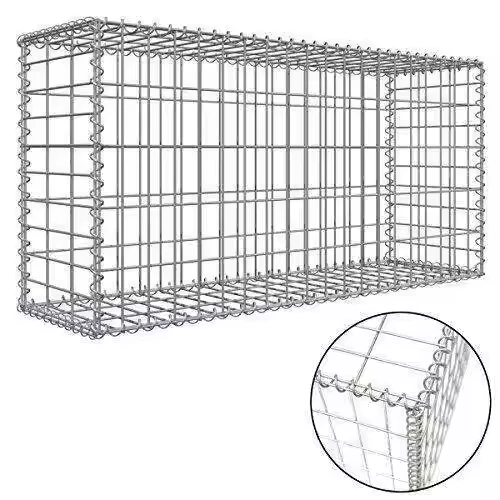

Understanding the steel net price is paramount for businesses dealing in the construction, automotive, or manufacturing sectors, where the cost of materials deeply impacts overall profit margins. Steel, a versatile and pivotal component in many industries, presents a pricing landscape that is nuanced and multifaceted, requiring a blend of expertise, real-world experience, authoritative insights, and trustworthiness to harness effectively.

Supply and demand dynamics are intrinsic to understanding price fluctuations. Seasonal demands, especially in construction and automotive industries, lead to temporary price volatilities. For instance, during peak construction seasons, the demand for steel skyrockets, leading to potential price increases unless offset by proportional production adjustments. From a trustworthiness standpoint, entities dealing with steel procurement must rely on credible suppliers and distributors. Trustworthy partnerships ensure not only fair pricing but also guarantee product quality and consistent supply chains. Establishing long-term relationships with reputed suppliers can mitigate the risks associated with sudden price hikes or supply disruptions. Furthermore, reliable suppliers often provide insights and forecasts about market trends, aiding in strategic decision-making for buyers. In terms of expertise, engaging with professionals who have an in-depth understanding of the industry can provide businesses with a distinct advantage. Industry experts often possess insider knowledge on forthcoming technological advancements, regulatory changes, and market trends that could affect steel prices. Companies can benefit by consulting with these experts to refine their purchasing strategies and enhance their market position. Having real-world experience in handling steel pricing negotiations offers an undeniable advantage. It equips professionals with the knowledge to craft flexible, informed purchasing strategies that accommodate the inevitable volatilities of the steel market. Experience aids in honing negotiation skills to secure favorable terms and in adapting strategies in response to rapid market changes. Navigating the complexities of steel net pricing demands a comprehensive approach that emphasizes expertise, experience, and reliability. As global markets continue to amalgamate and evolve, the ability to interpret pricing factors becomes even more critical. Businesses that arm themselves with the right information and partnerships stand to thrive, leveraging the steel market's intricacies to bolster their competitiveness and profitability.

Supply and demand dynamics are intrinsic to understanding price fluctuations. Seasonal demands, especially in construction and automotive industries, lead to temporary price volatilities. For instance, during peak construction seasons, the demand for steel skyrockets, leading to potential price increases unless offset by proportional production adjustments. From a trustworthiness standpoint, entities dealing with steel procurement must rely on credible suppliers and distributors. Trustworthy partnerships ensure not only fair pricing but also guarantee product quality and consistent supply chains. Establishing long-term relationships with reputed suppliers can mitigate the risks associated with sudden price hikes or supply disruptions. Furthermore, reliable suppliers often provide insights and forecasts about market trends, aiding in strategic decision-making for buyers. In terms of expertise, engaging with professionals who have an in-depth understanding of the industry can provide businesses with a distinct advantage. Industry experts often possess insider knowledge on forthcoming technological advancements, regulatory changes, and market trends that could affect steel prices. Companies can benefit by consulting with these experts to refine their purchasing strategies and enhance their market position. Having real-world experience in handling steel pricing negotiations offers an undeniable advantage. It equips professionals with the knowledge to craft flexible, informed purchasing strategies that accommodate the inevitable volatilities of the steel market. Experience aids in honing negotiation skills to secure favorable terms and in adapting strategies in response to rapid market changes. Navigating the complexities of steel net pricing demands a comprehensive approach that emphasizes expertise, experience, and reliability. As global markets continue to amalgamate and evolve, the ability to interpret pricing factors becomes even more critical. Businesses that arm themselves with the right information and partnerships stand to thrive, leveraging the steel market's intricacies to bolster their competitiveness and profitability.

Next:

Latest news

-

The Versatility of Stainless Steel Wire MeshNewsNov.01,2024

-

The Role and Types of Sun Shade SolutionsNewsNov.01,2024

-

Safeguard Your Space with Effective Bird Protection SolutionsNewsNov.01,2024

-

Protect Your Garden with Innovative Insect-Proof SolutionsNewsNov.01,2024

-

Innovative Solutions for Construction NeedsNewsNov.01,2024

-

Effective Bird Control Solutions for Every NeedNewsNov.01,2024