Secure Netting Solutions for Enhanced Cybersecurity

Understanding Security Netting A Key Component of Financial Risk Management

In the complex world of finance, risk management strategies are paramount to ensuring stability and profitability. One such strategy that has gained traction in recent years is security netting. This process plays a crucial role for financial institutions and corporations that engage in multiple transactions across various securities. To fully grasp the importance of security netting, it is essential to delve into its definition, benefits, and implications in financial operations.

At its core, security netting refers to the practice of offsetting exposures or obligations arising from multiple transactions between two or more parties. By consolidating these transactions, entities can effectively minimize their risk exposure, streamline their operational processes, and ensure that they do not face adverse consequences due to the fluctuations in market prices or exchange rates.

One of the principal benefits of security netting is the reduction of credit risk. In financial markets, participants are often subject to counterparty risk, which is the possibility that a counterparty will default on its obligations. By netting transactions, institutions can lower their overall exposure to any single counterparty, thus decreasing the potential financial fallout from defaults. This is particularly vital in times of market instability, where counterparty failures can lead to cascading effects across multiple entities.

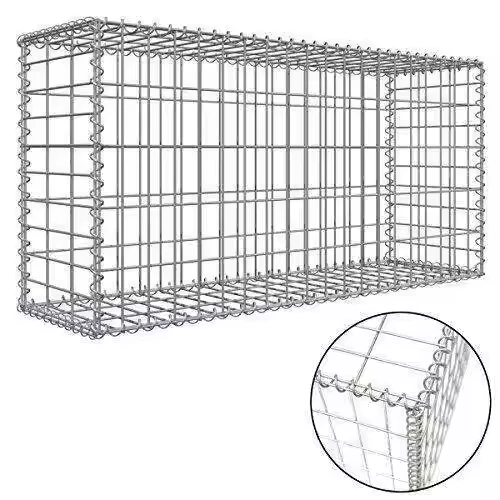

security netting

Additionally, security netting enhances liquidity management. Companies and financial institutions often deal with numerous receivables and payables. By netting these transactions, they can reduce the number of cash flows they need to manage, allowing for more efficient allocation of their resources and better cash flow prediction. This streamlined approach not only saves time but also reduces transaction costs associated with settling individual trades.

Moreover, security netting can contribute to regulatory compliance. In recent years, regulators have placed increased emphasis on risk management and the use of sound practices in the financial sector. By implementing robust security netting frameworks, organizations can demonstrate their commitment to risk mitigation and align themselves with regulatory expectations. This not only enhances their reputation but also positions them favorably in the eyes of regulators.

However, it is essential to recognize that security netting is not without its challenges. Implementing such systems requires meticulous planning and sophisticated technology to accurately track transactions and exposures. Furthermore, legal considerations surrounding netting agreements can complicate the process, as varying jurisdictions may have different regulations governing such practices. Consequently, a comprehensive understanding of both financial instruments and legal frameworks is vital for entities looking to adopt security netting strategies.

In conclusion, security netting plays a crucial role in the landscape of financial risk management. By offsetting obligations and exposures, it mitigates credit risk, enhances liquidity, and supports regulatory compliance. While the implementation of security netting presents challenges, its benefits can significantly impact an organization’s financial health and operational efficiency. As the financial landscape continues to evolve, embracing advanced risk management techniques like security netting will be essential for sustaining growth and stability in an increasingly interconnected world.

-

The Versatility of Stainless Steel Wire MeshNewsNov.01,2024

-

The Role and Types of Sun Shade SolutionsNewsNov.01,2024

-

Safeguard Your Space with Effective Bird Protection SolutionsNewsNov.01,2024

-

Protect Your Garden with Innovative Insect-Proof SolutionsNewsNov.01,2024

-

Innovative Solutions for Construction NeedsNewsNov.01,2024

-

Effective Bird Control Solutions for Every NeedNewsNov.01,2024